ReCoverCA Homebuyer Assistance Program

Up to $300,000 in Forgivable Loans for Eligible Households Impacted by 2023/24 Floods

Quick Links

Program Overview

Starting November 10, 2025, rental households impacted by the 2023 and 2024 California floods can apply for up to $300,000 in homebuyer assistance to help purchase homes in safer areas of California.

The homebuyer assistance is provided as a Second Mortgage Loan, forgiven after five years of continued ownership and occupancy. These funds can be applied toward the down payment and closing costs, and are designed to bridge the gap between the amount a family qualifies for in a First Mortgage and the actual purchase price of an eligible home.

To qualify, applicants must have had their primary residence in a designated Qualifying Disaster Area at the time of the flood and meet the program’s household Income Limits. Applicants must also meet the first-time homebuyer requirement, which is defined as not having owned a primary residence within the past three years (with limited exceptions).

Note: During the first 60 days of the application period (November 10, 2025 - January 12, 2026), priority will be given to households that can demonstrate they were impacted by a flood event.

Get Started Today

Use our Preliminary Eligibility Tool to answer questions like where you lived in 2023 or 2024 and your household income. The tool will help assess your information and provide an initial evaluation of your eligibility, along with the next steps. For any assistance, feel free to Contact Us.

When you're ready to discuss your financial situation and/or begin the formal application process, you'll need to work with a ReCoverCA HBA Lender. GSFA partners with a network of trusted lenders who will determine your final eligibility, provide current interest rates and APRs, and process your application for the Program.

Note: Funding is limited; pre-qualification is highly encouraged.

Current Funding

Updated October 23, 2025

2023/24 Flood Recovery

Homebuyer assistance funds for the 2023 and 2024 flood events will be available for reservation starting November 10, 2025.

2023 Qualifying Disaster Area

- Hoopa Valley Tribe (Zip Code 95546)

- Monterey County

- San Benito County

- Santa Cruz County

- Tulare County

- Tuolumne County

2024 Qualifying Disaster Area

- San Diego County

ReCoverCA Homebuyer Assistance

Program Policies and Eligibility Requirements(1)

This section further explains the current funding available through the ReCoverCA Homebuyer Assistance Program, including key program policies, eligibility requirements, and the terms of the financial assistance. It is intended to help prospective homebuyers understand what is required and how the Program can support their path to safe, affordable homeownership. For complete program details — including loan applications, interest rates, and APRs — please contact a ReCoverCA HBA Lender.

Mortgage Qualifying Guidelines

To participate in the Program, applicants must first qualify for a First Mortgage Loan and meet the following requirements:

- Household Income Limit

Must be at or below 80% of the Area Median Income (AMI), as defined by HUD for low-to-moderate income households - First-time Homebuyer Requirement

Must qualify as a first-time homebuyer (no prior homeownership in the past three years). Some exceptions may be provided to applicants who owned a home in the qualifying area at the time of disaster, were impacted by this disaster and have since sold the home - Debt-to-Income Ratio (DTI)

Monthly housing costs and debts must be at least 42% but no more than 45% of gross household income - Credit Score

Minimum FICO score of 640 - Homebuyer Education Course

At least one borrower must complete an approved 8-hour online homeownership course. The small fee for this course can be covered with the homebuyer assitance funds

Homebuyer Assistance Terms

The Program currently provides homebuyer assistance for the 2023/24 flood disasters in the form of a forgivable Second Mortgage Loan (HBA Loan), with 0% interest and no monthly payments.

- Second Mortgage Loan

- 0% interest, no monthly payments

- Forgiven after five years

The HBA Loan can be used for down payment and closing costs and is fully forgiven after five years of continuous occupancy as the homeowner’s primary residence. If the homeowner sells, transfers the property, or no longer occupies the home before the five-year period ends, a prorated amount of the HBA will be required to be repaid.

Calculating Your Assistance Amount

The assistance amount is calculated as the gap between your qualifying First Mortgage Loan and the lower of the home’s purchase price or appraised value. It may be reduced if you have unused housing assistance from other sources or cash reserves over $100,000. The maximum HBA Loan available is $300,000 per household.

A ReCoverCA HBA Lender will work with you to determine your exact eligibility.

Properties Eligible for Purchase

Properties eligible for purchase through the Program must be located in California outside of both a FEMA-designated Special Flood Hazard Area and a CalFire High or Very High Fire Hazard Severity Zone.

Eligible Property Types

- Single-family homes (1 unit only)

- Townhomes

- Agency-approved condominiums

- Planned unit developments (PUDs)

- Manufactured housing (on a permanent foundation)

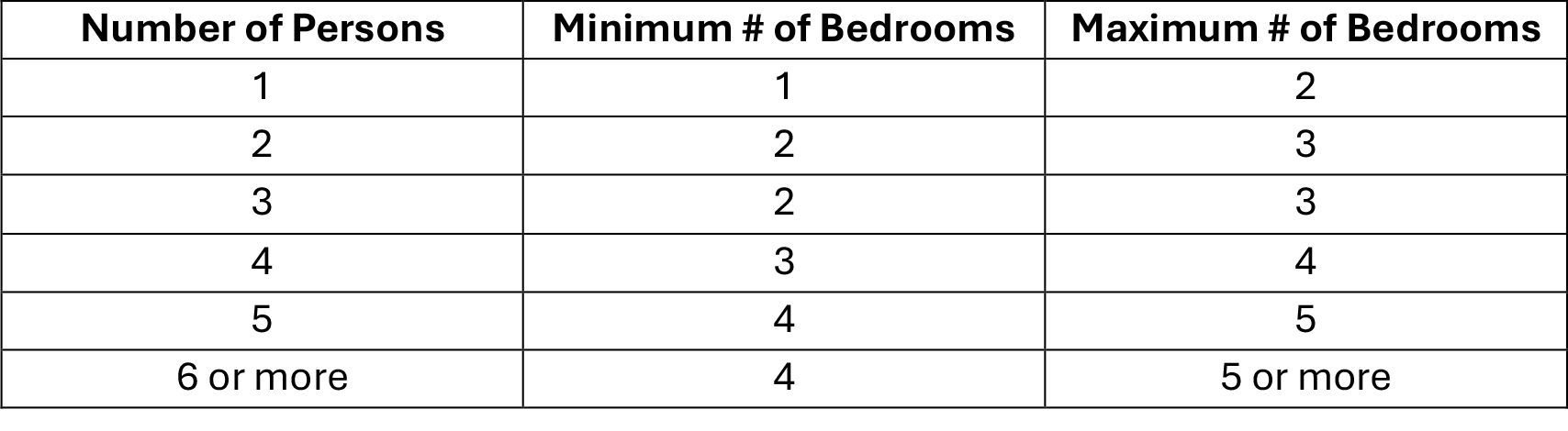

Number of Bedrooms

The number of bedrooms allowed is based on the number of persons in the household as set forth below:

Applicants are encouraged to consult with a ReCoverCA HBA Lender to determine if a property meets eligibility requirements.

Questions or Ready to Get Started?

(1)This web page contains general program information, is not an offer for extension of credit nor a commitment to lend and is subject to change without notice. Complete program policies, eligibility requirements, loan applications, interest rates and annual percentage rates (APRs) are available through ReCoverCA HBA Lenders.

The ReCoverCA Homebuyer Assistance (DR-HBA) Program is provided by the California Department of Housing and Community Development (HCD) in collaboration with GSFA as Program Manager. Funding for the Program is made possible through a Community Development Block Grant - Disaster Recovery (CDBG-DR) grant from HUD.

What People Say?

It felt like a heavy weight was lifted.

Thanks to the ReCoverCA program, I am now the proud owner of a gorgeous new home in Chico, California. Because of this program, I was not only able to afford a home outside of the high fire danger area, but a home with the most up to date fire prevention possible. Even as a single income family.