GSFA MCC® — Overview

Program Overview

GSFA MCC® — Mortgage Credit Certificate

Availability of Funds

Updated January 1, 2025

Fully Allocated

Funding is limited and provided to eligible borrowers on a first-come, first-served basis. All Program funds are currently allocated.

GSFA will provide a lender announcement as soon as MCC funds are made available via the California Debt Limit Allocation Committee (CDLAC).

Providing an Annual Tax Credit to First-Time Homebuyers and Qualified Veterans(1)

Many First-time Homebuyers(2) have never heard about a Mortgage Credit Certificate (MCC), which is unfortunate because an MCC can save a homeowner some serious money over the life of their First Mortgage Loan, starting the very first year.

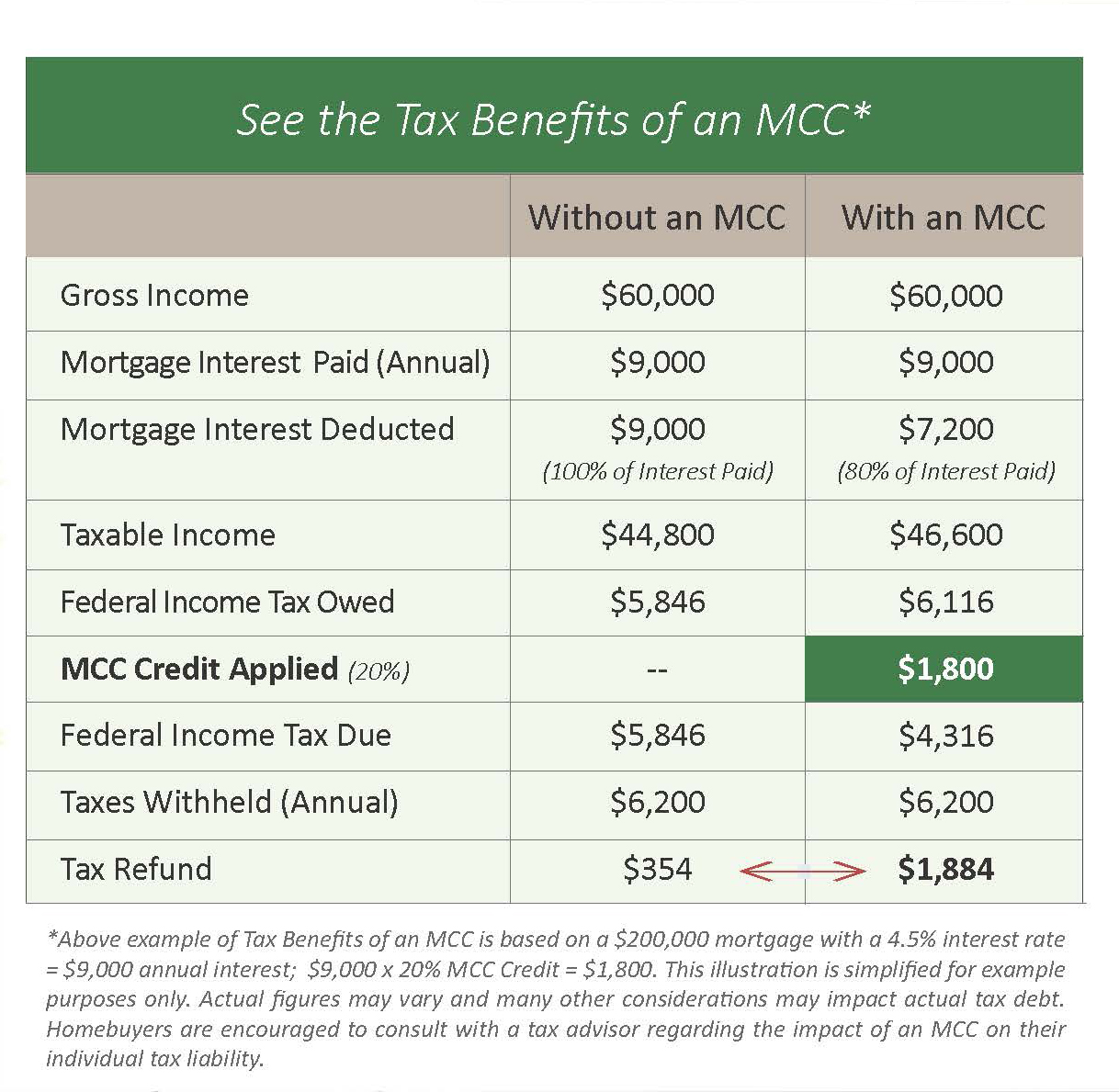

When an MCC is issued to a homeowner at the same time that they close their new mortgage loan, he/she will be able to file for a tax credit on their next year's federal income taxes. The credit for the GSFA MCC Program is 20% of the annual mortgage interest paid. It is a dollar-for-dollar reduction in federal income tax liability.

Advantages of an MCC

An MCC can be obtained with a variety of First Mortgage Loans, including Conventional, FHA, VA and USDA loans, and coupled with Affordable Housing Programs such as the GSFA Down Payment Assistance Programs. A GSFA MCC Lender will help the homebuyer apply for the MCC at the same time he/she applies for a First Mortgage Loan.

Dollar-for-dollar Tax Credit

An MCC allows a homeowner to get back a substantial portion of the mortgage interest paid every year.

For the GSFA MCC Program, 20% of the annual mortgage interest paid can be taken as a tax credit. The remaining 80% of mortgage interest paid can still be taken as an itemized tax deduction1.

In general, one must be a First-time Homebuyer to qualify for an MCC. However, there are exceptions, such as if the borrower is a qualified veteran or the home being purchased is located in a federally designated "Targeted Area".

Long-term Savings

The tax credit can be taken every year, so long as the home remains the borrower's principal residence and they pay interest on the First Mortgage Loan.

In addition, if the homeowner refinances, he/she can apply for a re-issuance of the MCC certificate (RMCC) to continue to file for the annual tax credit for the remaining term of the original purchase loan.

Improves Qualifying Power

An MCC can help the homebuyer qualify for the initial First Mortgage Loan and may also increase the homebuyer's purchasing power.

Depending on the First Mortgage Loan type, the estimated tax credit can impact "available income", debt-to-income ratio or other eligibility factors. Homebuyers are encouraged to discuss this further with a GSFA MCC Lender.

(1) Program highlights only. Certain restrictions apply on all programs. See a GSFA MCC Lender for complete program guidelines and/or to apply for a GSFA MCC. Homebuyers are also encouraged to consult with a tax advisor regarding the impact of an MCC on their individual tax liability.

(2) First-time Homebuyer is defined as someone who has not owned a primary residence in at least three years. The First-time Homebuyer requirement for the GSFA MCC Program is waived if the homebuyer is purchasing in specific areas called "Targeted Areas" or if he/she is a qualified U.S. veteran.

Show Me

FAQs

Frequently Asked Questions

Click the questions below to review the answers.

Applications are accepted on a first-come, first-serve basis through GSFA MCC Participating Lenders only. The Lender will submit the homebuyer's MCC application directly to GSFA.

Please note that the GSFA MCC Program is currently out of funds, and therefore we are unable to accept new applications at this time. Please check back for updates.

When the Lender submits the application to GSFA, they also reserve the GSFA MCC funds through the Program Manager's Online Reservation System. This reservation will hold the MCC while the lender is processing the First Mortgage Loan application. The Program Manager then processes the GSFA MCC Application and, once approved, will issue a GSFA MCC Commitment to the Lender. The Lender then finishes processing and closing the First Mortgage Loan.

After the First Mortgage Loan closes, the Lender will submit a GSFA MCC Closing Package with the applicable fee to the Program Manager for review. Once the MCC Closing Package is reviewed and approved, the Program Manager will issue the physical Mortgage Credit Certificate to the homebuyer. Once the homebuyer receives this document, they may start benefiting from the MCC.

A mortgage interest deduction differs from a mortgage tax credit in a number of ways. For example, all homebuyers, regardless of income, may take a mortgage interest deduction, whereas mortgage tax credits are available only to holders of MCCs.

A tax deduction or a tax-deductible expense affects a taxpayer's income tax. A tax deduction represents an expense incurred by a taxpayer. They are variable amounts that a taxpayer can subtract, or deduct, expenses from gross income when computing his/her income taxes. As a result, the tax deduction lowers the overall taxable income and thus lowers the amount of tax paid.

A tax credit is a similar concept, but is different in that it reduces the tax owed, rather than reducing taxable income. This amount of tax savings is not dependent on the rate the taxpayer pays.

An MCC provides a tax credit, based on a percentage (as determined by the Program guidelines) of the mortgage interest paid annually. The remaining mortgage interest paid annually may still be taken as a tax deduction when the taxpayer computes his or her income taxes.

The new MCC holder may receive the complete MCC tax credit saving annually at the time they file their tax return. Or they may receive the benefits monthly by adjusting their federal income tax withholding by filing a revised W-4 with their employer. By filing a revised W-4, the number of exemptions will increase, reducing the amount of taxes withheld and increasing the disposable net income.

Note: Homebuyers are encouraged to consult with a tax advisor and employer to help them with the necessary tax forms and, if they so choose, to properly adjust their tax withholding.

The GSFA MCC holder will need to Contact Us to request a replacement certificate. A fee may apply.

The MCC may be reissued in the event the homeowner refinances, if the Re-issuance MCC Application (RMCC) is submitted and approved by GSFA within one year of the refinance and if the homeowner qualifies under the program guidelines. A RMCC is required for any refinances subsequent to the original purchase loan and any subsequent refinances.

The term on an RMCC will be the term of the original purchase loan. For example, if the original pruchase loan was a 30-year term loan and the homeowner refinanced after 5 years, and acquired a re-issuance of the MCC with that refinance, they would only be able to continue to file for the MCC tax credit another 25 years. In addition, an RMCC non-refundable application fee may apply. Contact Us for complete guidelines or to apply for an RMCC from GSFA.